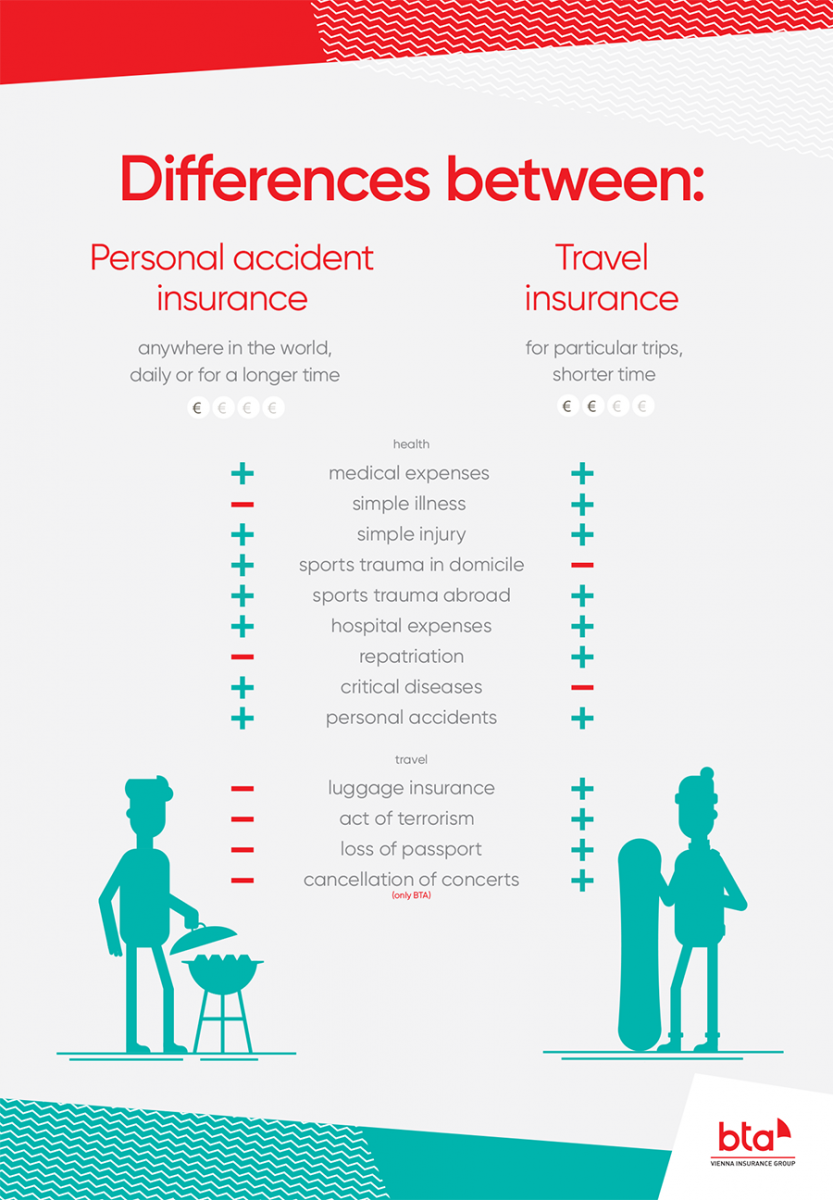

Travel insurance and accident insurance are two different types of insurance policies that offer different coverage and benefits to individuals.

Travel insurance is a policy designed to cover unexpected events that may occur while traveling. It provides coverage for trip cancellation or interruption, loss of baggage, medical emergencies, and other travel-related expenses. This insurance protects travelers from financial loss or inconvenience due to unforeseen circumstances, such as flight cancellations, lost luggage, or emergency medical treatment.

On the other hand, accident insurance is a policy that provides financial protection in the event of an accident resulting in injury, disability, or death. This insurance is specifically focused on accidents and their consequences. It covers medical expenses, hospitalization costs, rehabilitation, and disability benefits. Accident insurance is beneficial for individuals who are at a higher risk of accidents, such as those involved in high-risk occupations or activities.

The main difference between travel insurance and accident insurance lies in their coverage and scope. While travel insurance offers comprehensive coverage for various travel-related events and expenses, accident insurance focuses solely on accidents and the subsequent financial consequences. Travel insurance covers a wide range of scenarios, including trip cancellations, medical emergencies, lost luggage, and travel delays, while accident insurance concentrates on injuries caused by accidents.

In summary, travel insurance and accident insurance serve different purposes. Travel insurance protects individuals during their travels by providing coverage for a wide range of travel-related events, while accident insurance offers financial protection specifically for accidents resulting in injury or disability. It is important to carefully consider one’s needs and risks before choosing the appropriate insurance policy. Both types of insurance can provide valuable financial protection, but their coverage and benefits differ based on individual requirements.

What are the two 2 basic types of travel insurance?

The two most common types of travel insurance to purchase for medical coverage are comprehensive plans and medical-specific plans. Each covers medical-related costs differently.

What is business accident insurance?

Business Travel Accident Insurance, also commonly known as BTA, is travel insurance secured by a company to protect their employees while they are traveling abroad for business.

What is BTA insurance?

Business Travel Accident InsuranceAccident InsuranceAccident insurance is a type of insurance where the policy holder is paid directly in the event of an accident resulting in injury of the insured. The insured can spend the benefit payment however they choose. Accident insurance is complementary to, not a replacement for, health insurance.https://en.wikipedia.org › wiki › Accident_insuranceAccident insurance – Wikipedia is an inexpensive but valuable benefit that supplements any employee benefit program. This plan provides protection for employees who travel on business domestically or internationally, foreign employees of U.S.-based businesses and U.S. employees on offshore assignments.

Which type of medical coding is best?

However, not all medical coder certifications provide the same value for job seekers. The best certifications for a medical coder are Certified Billing and Coding Specialist (CBCS), Certified Coding Specialist (CCS), and Certified Professional Coder (CPC).

What type of medical coder makes the most money?

– Coding Director. Salary range: $44,500-$122,000 per year. …

– Coding and Reimbursement Specialist. Salary range: $59,000-$97,000 per year. …

– Coding Manager. Salary range: $52,000-$83,000 per year. …

– Medical Coding Auditor. …

– Hospital Coder. …

– Coding Compliance Specialist. …

– Coder. …

– Medical Coding Manager.

What state pays medical billers the most?

– District of Columbia. Employment: 610. Annual Mean Wage: $69,290.

– New Jersey. Employment: 1,630. Annual Mean Wage: $60,310.

– Alaska. Employment: 710. Annual Mean Wage: $52,040.

– California. Employment: 18,860. Annual Mean Wage: $48,590.

– Maryland. Employment: 3,890.

What medical coder gets paid most?

– Coding Director. Salary range: $44,500-$122,000 per year. …

– Coding and Reimbursement Specialist. Salary range: $59,000-$97,000 per year. …

– Coding Manager. Salary range: $52,000-$83,000 per year. …

– Medical Coding Auditor. …

– Hospital Coder. …

– Coding Compliance Specialist. …

– Coder. …

– Medical Coding Manager.

How much do medical billers get paid in CA?

Annual Salary Weekly Pay

————— ————- ———-

Top Earners $59,214 $1,138

75th Percentile $48,900 $940

Average $42,732 $821

25th Percentile $38,000 $730