Cardone says that from your gross income, 40% should be set aside for taxes, 40% should be saved, and you should live off of the remaining 20%.

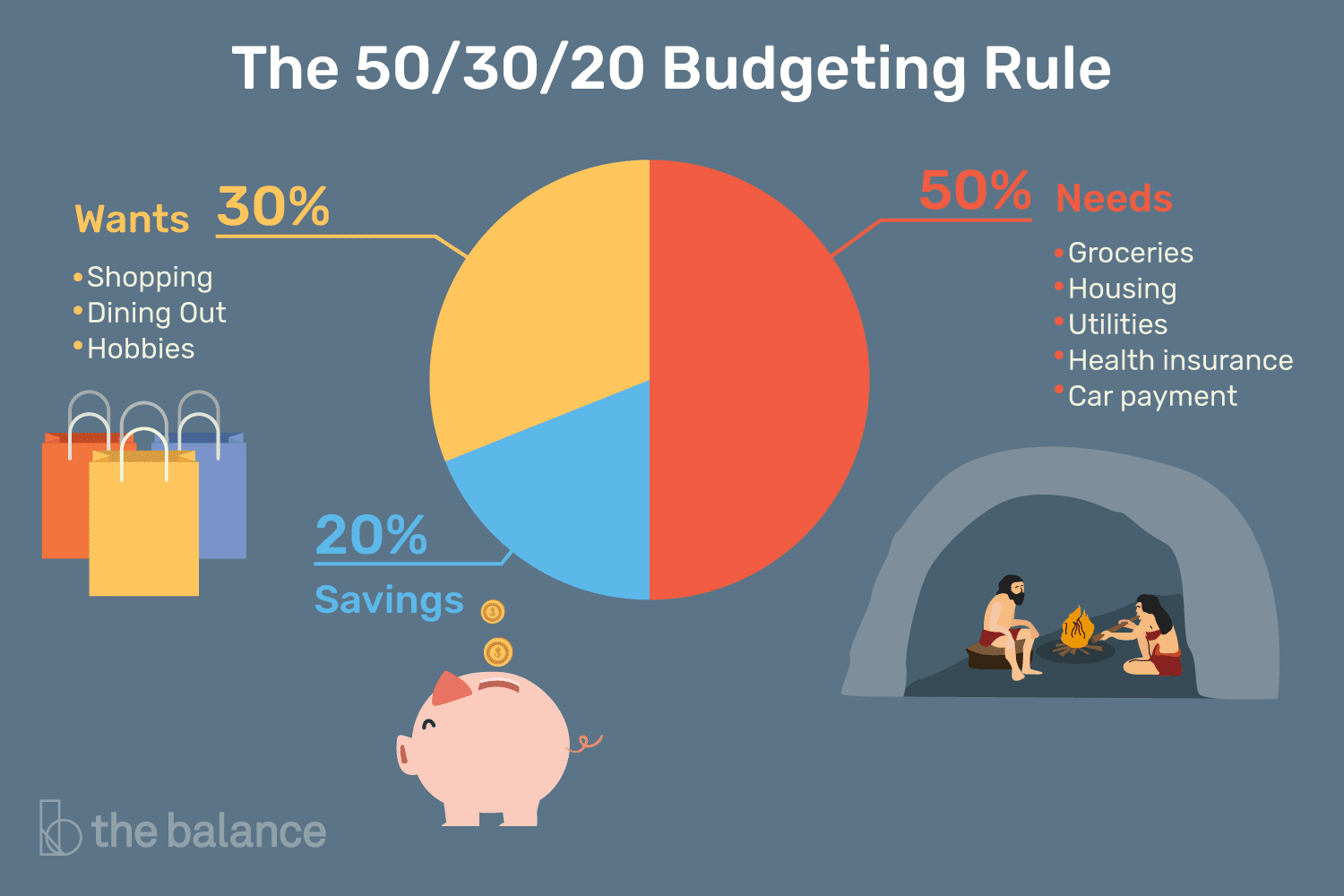

What is the 50/30/20 rule in finance?

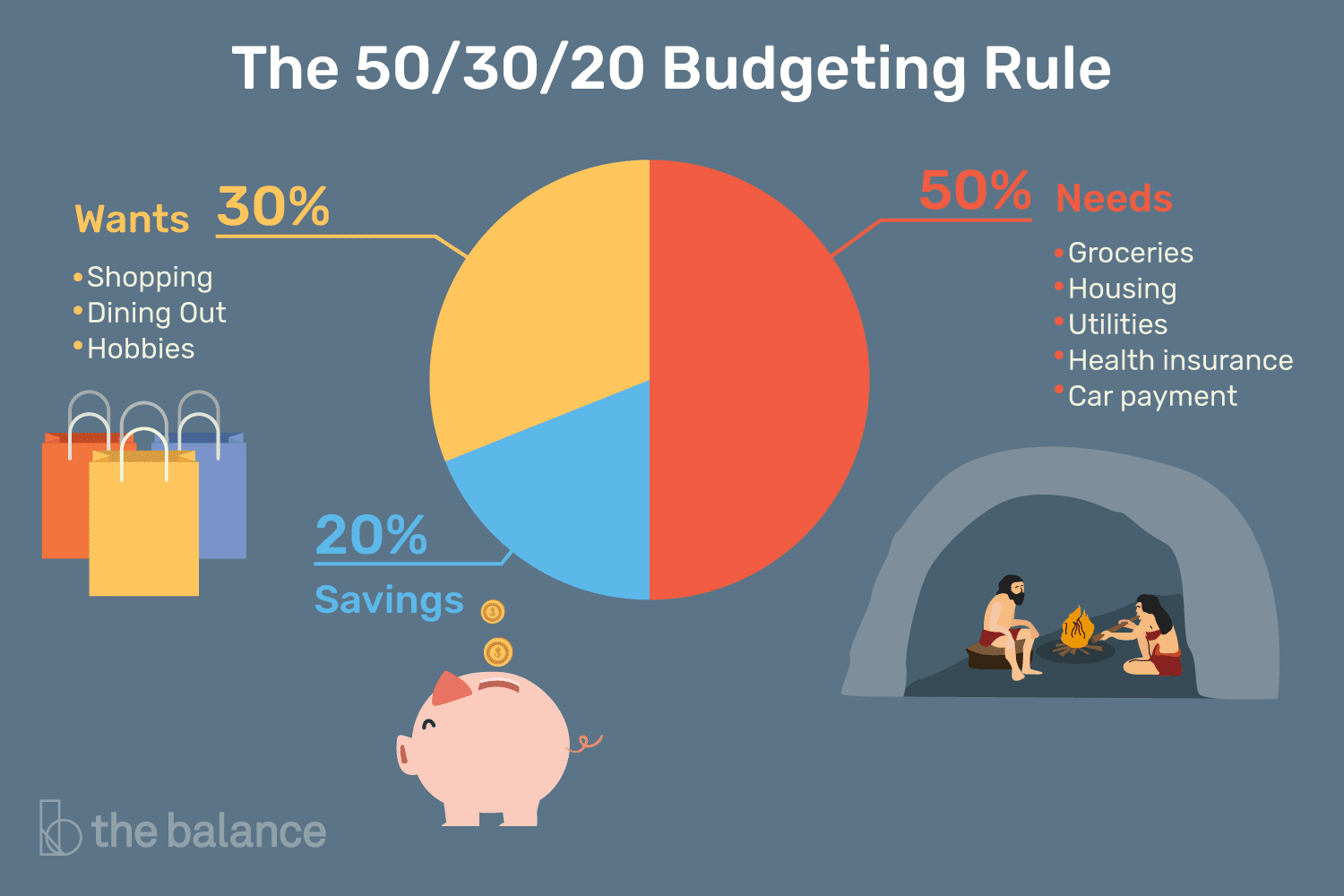

The 50-30-20 rule recommends putting 50% of your money toward needs, 30% toward wants, and 20% toward savings. The savings category also includes money you will need to realize your future goals.

What is the 50 30 20 rule for debt?

Key Takeaways. The 50/30/20 budget rule states that you should spend up to 50% of your after-tax income on needs and obligations that you must have or must do. The remaining half should be split between savings and debt repayment (20%) and everything else that you might want (30%).

What is the 70 20 10 rule for personal finance?

The 70-20-10 budget formula divides your after-tax income into three buckets: 70% for living expenses, 20% for savings and debt, and 10% for additional savings and donations. By allocating your available income into these three distinct categories, you can better manage your money on a daily basis.

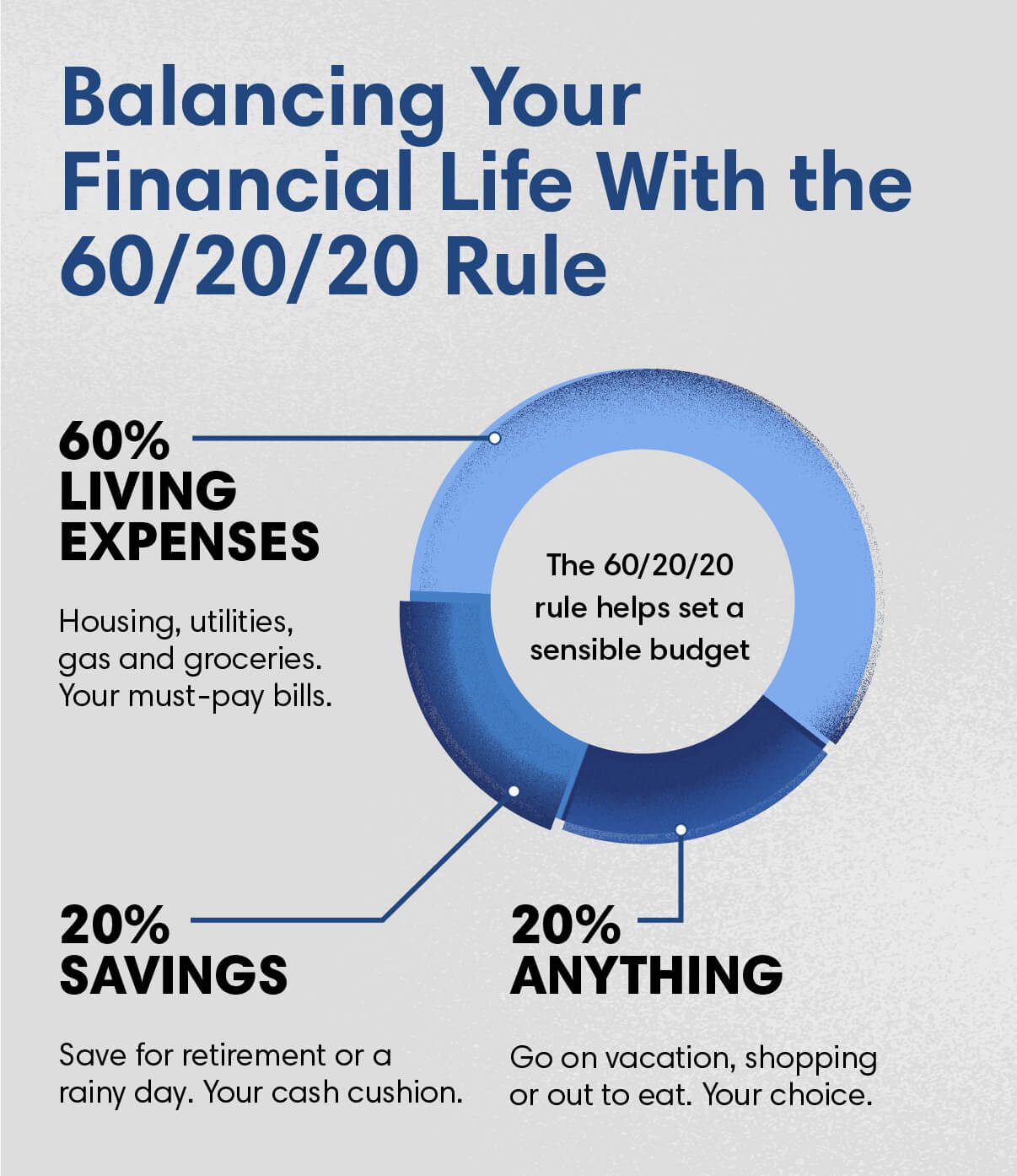

What is the 60 20 20 rule in finance?

If you have a large amount of debt that you need to pay off, you can modify your percentage-based budget and follow the 60/20/20 rule. Put 60% of your income towards your needs (including debts), 20% towards your wants, and 20% towards your savings.