#1 Don’t Spend More Than You Make When your bank balance is looking healthy after payday, it’s easy to overspend and not be as careful. However, there are several issues at play that result in people relying on borrowing money, racking up debt and living way beyond their means.

What are the 5 basics of personal finance?

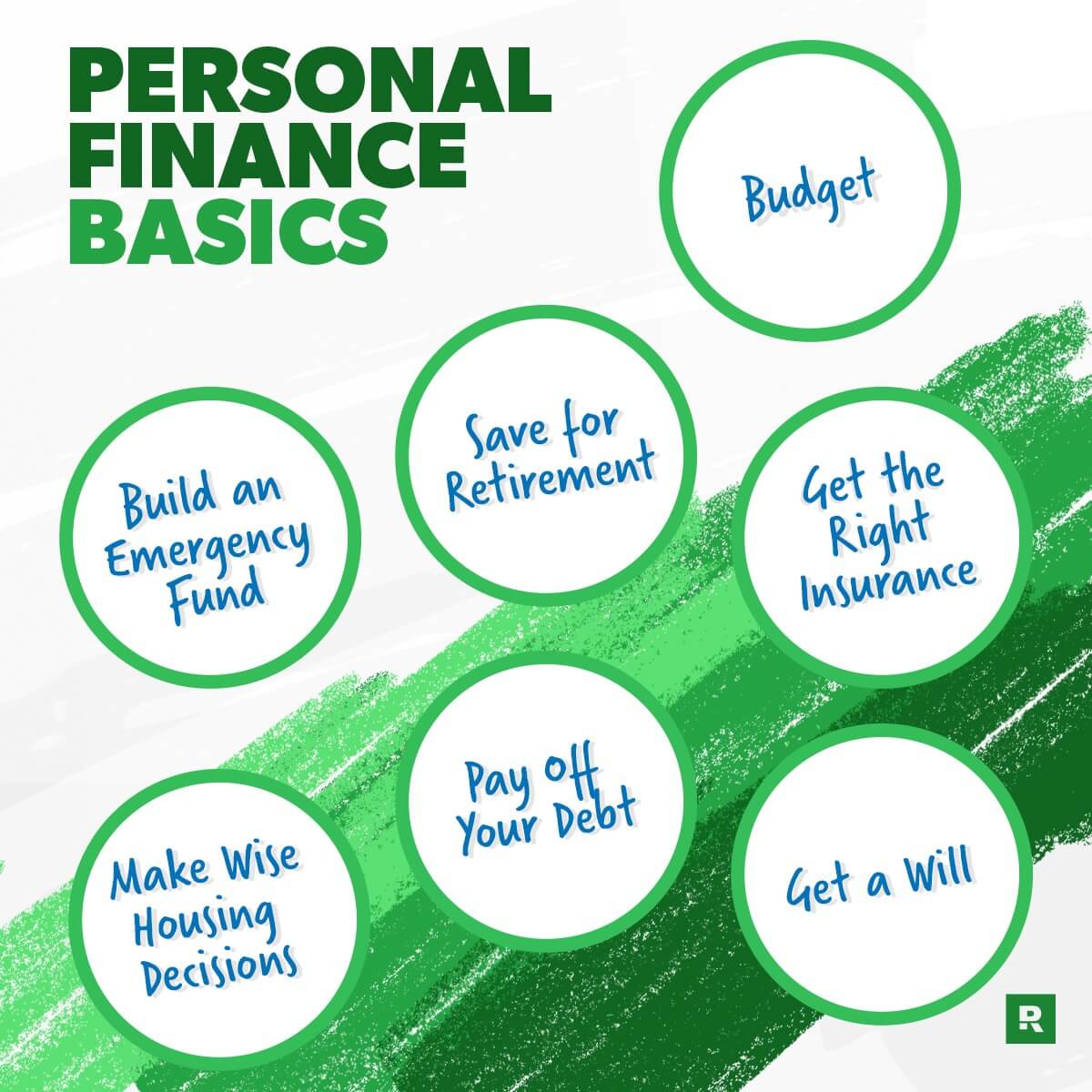

There’s plenty to learn about personal financial topics, but breaking them down can help simplify things. To start expanding your financial literacy, consider these five areas: budgeting, building and improving credit, saving, borrowing and repaying debt, and investing.

What are the 5 P’s of finance?

I refer to these as the “Five Ps” of business success: Product, Pricing, People, Process, and Planning. These foundational elements encompass the resources critical to a strategic plan that prioritizes factors to move your company forward, maintain positive cash flow, and create an environment for growth.

What are the 5 main areas of personal finance?

– The five main areas of personal finance are income, spending, saving, investing, and protection. …

– Every financial plan starts with income, which comes from a salary, bonuses, hourly wage, dividends, pensions, or a combination of all.

What are 5 personal finance strategies?

The five areas of personal finance are income, saving, spending, investing, and protection.