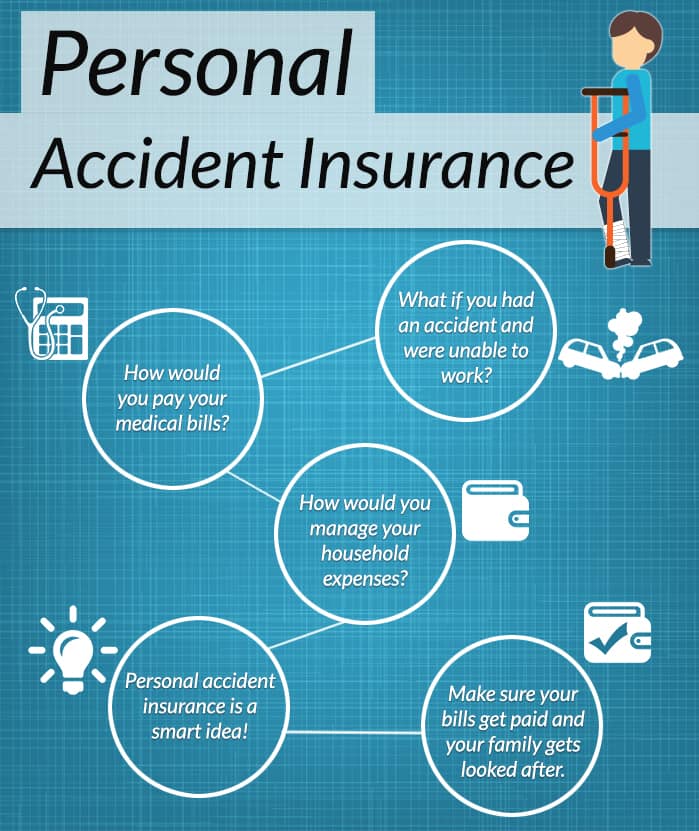

Personal accident insurance provides financial protection to individuals in the event of accidents or injuries that result in disability or death. This type of insurance covers a wide range of accidents, including those that occur at work, on the road, at home, during recreational activities, or even accidents caused by others.

One of the main features of personal accident insurance is coverage for medical expenses. In the event of an accident, the insurance policy would pay for hospitalization, surgery, medication, and other medical treatments. This ensures that individuals do not have to bear the burden of hefty medical bills and can focus on recovering without worrying about the financial aspect.

Another important coverage provided by personal accident insurance is disability income. In case an accident leads to temporary or permanent disability, the policyholder would receive a regular income payout to compensate for the loss of income. This allows individuals to maintain their financial stability during the recovery period or throughout their life if the disability is permanent.

Personal accident insurance also offers coverage for accidental death. In the unfortunate event of the policyholder’s death due to an accident, the insurance company would provide a lump sum amount to the beneficiary or family members. This financial support can be used to cover funeral expenses, outstanding debts, or to provide for the family’s long-term financial needs.

Moreover, personal accident insurance may provide additional benefits such as ambulance fees, transportation expenses, childcare benefits, and even psychological counseling. These benefits aim to alleviate the financial and emotional stress caused by accidents and help individuals and their families cope with the aftermath more effectively.

In summary, personal accident insurance provides comprehensive coverage for medical expenses, disability income, accidental death, and various other benefits. It offers financial protection and peace of mind to individuals and their families in the face of unexpected accidents or injuries.

What does the personal accident cover?

Accident insuranceAccident insuranceAccident insurance is a type of insurance where the policy holder is paid directly in the event of an accident resulting in injury of the insured. The insured can spend the benefit payment however they choose. Accident insurance is complementary to, not a replacement for, health insurance.https://en.wikipedia.org › wiki › Accident_insuranceAccident insurance – Wikipedia covers qualifying injuries, which might include a broken limb, loss of a limb, sprains, broken bones, concussions, burns, lacerations, or paralysis. In the event of your accidental death, accident insurance pays out money to your designated beneficiary.Sep 1, 2023

What does accidental life insurance cover?

What is AD&D insurance? Accidental death and dismemberment (AD&D) insurance is a category of life insurance that only pays out a benefit when the insured is in a covered accident that causes death or specific serious injuries such as the loss of a limb, paralysis, or blindness.

What is personal accident life insurance?

What does Personal Accident InsuranceAccident InsuranceAccident insurance is a type of insurance where the policy holder is paid directly in the event of an accident resulting in injury of the insured. The insured can spend the benefit payment however they choose. Accident insurance is complementary to, not a replacement for, health insurance.https://en.wikipedia.org › wiki › Accident_insuranceAccident insurance – Wikipedia Cover? Coverage against accidental death of the policyholder. Coverage for partial or permanent disability arising due to accident. Coverage for hospitalization expenses and other medications.

What does accident insurance cover?

Accident insurance covers qualifying injuries, which might include a broken limb, loss of a limb, sprains, broken bones, concussions, burns, lacerations, or paralysis. In the event of your accidental death, accident insurance pays out money to your designated beneficiary.Sep 1, 2023