A person making $60,000 per year can afford about a $40,000 car based on calculating 15% of their monthly take-home pay and a 20% down payment on the car of $7,900.

How much car can I afford on a 50k salary?

Start With Your Gross Income To get an idea of how much car you can afford, a good rule of thumb is to pay no more than 35% of your annual pre-tax income. So, if you make $50,000 before taxes per year, your car purchase price should not exceed $17,500.

How much house can I afford if I make 60k a year?

The general guideline is that a mortgage should be two to 2.5 times your annual salary. A $60,000 salary equates to a mortgage between $120,000 and $150,000.

How can I comfortably finance my car?

Consider your monthly budget As a general rule of thumb, many experts suggest following the 20/4/10 rule, which holds that you should set aside 20% of a car’s purchase price for a downpayment, take 4 years to repay your car loan, and ensure that your monthly transportation costs don’t exceed 10% of your monthly income.

What car can I afford with a 40k salary?

on the price of a car. is not to exceed 35% of your gross income. That means if you make $40,000 a year, the cars price should not exceed $14,000. If you make $80,000, the cars price should be below $28,000. And at 150 k salary, that means your max car price should be 50 2500.

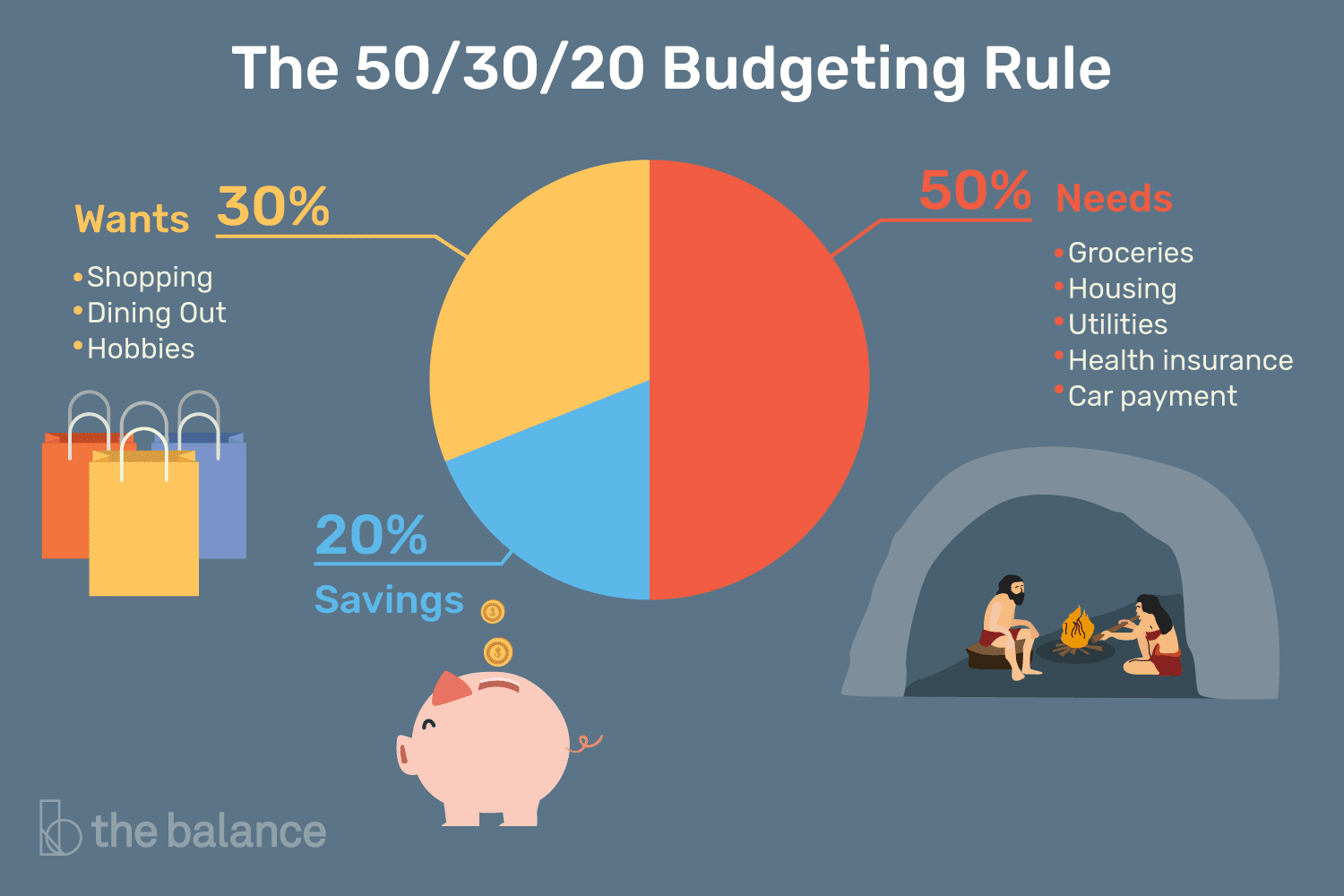

What is the 50/30/20 rule?

The 50-30-20 rule recommends putting 50% of your money toward needs, 30% toward wants, and 20% toward savings. The savings category also includes money you will need to realize your future goals.

Is the 30% rule outdated?

The 30% Rule Is Outdated Rather than looking at what consumers should be spending on housing, however, the government selected these percentages because that’s what consumers were spending. Abiding by the 30% rule as the de facto personal finance rule is outdated and does not accurately reflect today’s living expenses.May 8, 2024

How much money is enough to be financially free?

Americans say they’d need to earn about $94,000 a year on average to feel financially independent. That’s about $20,000 more than the median household income of $74,580.

Is the 50 30 20 rule outdated?

But amid ongoing inflation, the 50/30/20 method no longer feels feasible for families who say they’re struggling to make ends meet. Financial experts agree — and some say it may be time to adjust the percentages accordingly, to 60/30/10.

How to become financially free quickly?

– Learn How to Budget.

– Get Debt Out of Your Life—For Good.

– Set Financial Goals.

– Be Smart About Your Career Choice.

– Save Money for Emergencies.

– Plan for Big Purchases.

– Invest for Your Retirement Future.

– Look for Ways to Save Money.