Liability insurance is a crucial form of protection for individuals, businesses, and organizations. This type of insurance provides coverage for legal claims made against the policyholder for bodily injury or property damage caused to a third party.

Liability insurance can help cover legal fees, court costs, and settlements or judgments that may arise in the event of a covered claim. Without liability insurance, individuals and businesses risk facing financial ruin due to costly legal claims.

There are different types of liability insurance policies, such as general liability, professional liability, and product liability insurance, each tailored to specific industries and professions. It is important for individuals and businesses to assess their risks and choose the right type of liability insurance to adequately protect themselves.

In conclusion, liability insurance is highly beneficial in protecting individuals and businesses from the financial consequences of legal claims. By securing a liability insurance policy, policyholders can have peace of mind knowing that they are covered in the event of unforeseen accidents or incidents.

Is it a good idea to get liability insurance?

Should I get liability or full coverage car insurance? Typically, it is advisable to purchase full coverage car insurance. Liability insurance will not pay for damages to your own vehicle after an accident where you are at fault. It will also not cover damages due to theft, vandalism or acts of nature.

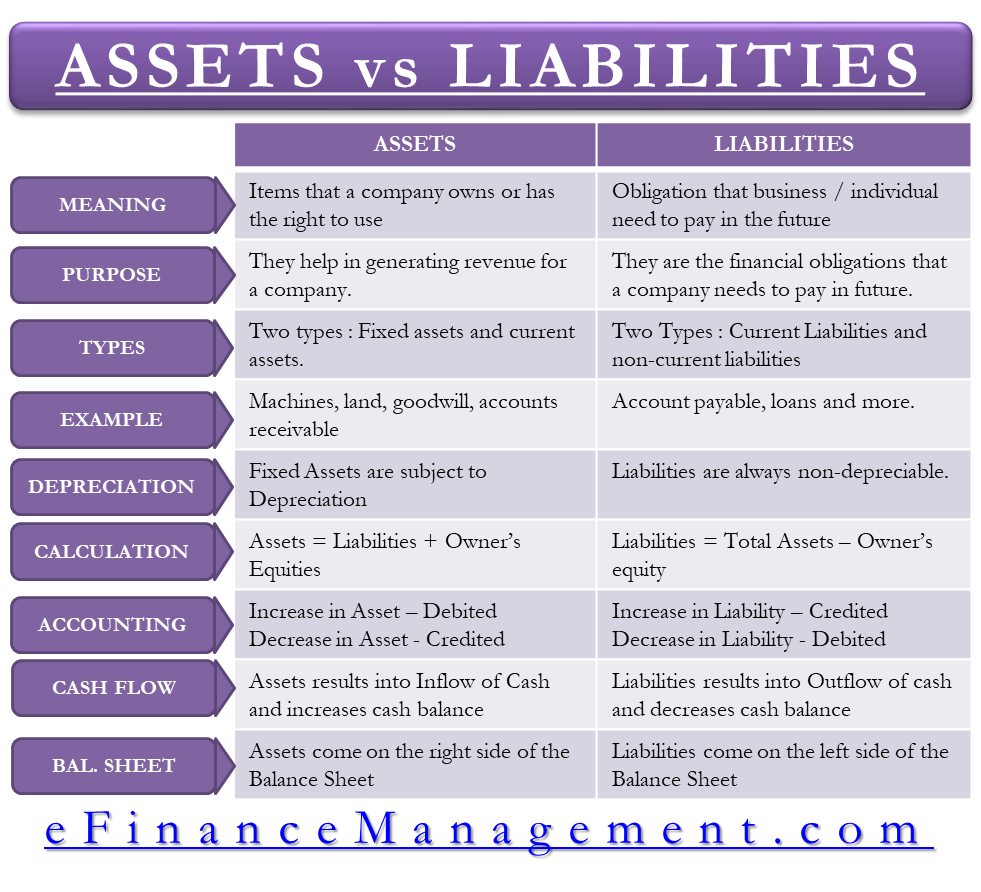

Is liability insurance an asset or liability?

Liability: Insurance is perceived as a liability due to the financial commitment made by individuals or businesses. Premium payments represent future cash outflows, and failure to make these payments could lead to the cancellation of coverage. Asset: Insurance functions as an asset by providing financial protection.

What is insurance classified as in accounting?

Any insurance premium costs that have not expired as of the balance sheet date should be reported as a current asset such as Prepaid Insurance. The costs that have expired should be reported in income statement accounts such as Insurance Expense, Fringe Benefits Expense, etc.

What category is liability insurance?

Risk Management Expenses Another possibility is to classify general liability insurance as a risk management expense. This is because the insurance protects the business from liability, and the cost of the insurance is directly related to the risk of liability.