Kansas is not a no-fault state when it comes to car accidents. In no-fault states, each driver’s insurance company is responsible for covering their medical expenses and other damages, regardless of who was at fault for the accident. However, in Kansas, fault is a crucial factor in determining which driver’s insurance will pay for the damages.

Kansas operates under a traditional fault-based system, where the driver who is found to be at fault for the accident is held financially responsible for the injuries and property damage caused. This means that the injured party can file a claim with the at-fault driver’s insurance company in order to seek compensation for their losses.

To determine fault, Kansas follows a comparative negligence rule. This means that the negligence of each party involved in the accident is assessed, and the compensation is adjusted accordingly. If a driver is found to be partially at fault for the accident, their compensation will be reduced by their percentage of fault. However, if a driver is found to be more than 50% at fault, they may be barred from recovering any compensation from the other party.

It is important for drivers in Kansas to have appropriate car insurance coverage to protect themselves in case of an accident. The state mandates minimum liability coverage, which includes $25,000 for bodily injury per person, $50,000 for bodily injury per accident, and $25,000 for property damage per accident.

In conclusion, Kansas is not a no-fault state. Fault is a crucial factor in determining which driver’s insurance will cover the damages, and the state follows a comparative negligence rule. It is essential for drivers to have sufficient insurance coverage to protect themselves in case of an accident.

Is Kansas a PIP state?

Kansas PIP Coverage Unlike Missouri, Kansas drivers are legally required to carry PIP coverage as part of their car insurance policy. Kansas drivers must have at least $4,500 per individual in PIP coverage. This minimum will cover the medical expenses of an individual injured in an accident up to $4,500.

What happens if the person at-fault in an accident has no insurance in Kansas?

Fortunately, all is not lost if the at-fault party had no (or minimal) insurance. Depending on the severity of your injuries, we may be able to pursue other avenues to claim the following expenses under Kansas personal injury laws: Medical, hospital and surgical expenses (past, present and future)

What is the minimum liability insurance in Kansas?

Kansas Minimum Car Insurance Requirements Your liability insurance minimums for Kansas are: $25,000 bodily injury liability per person. $50,000 bodily injury liability per accident. $25,000 property damage liability per accident.

How long does an insurance company have to settle a claim in Kansas?

In general, an insurer has 30 days to pay a clean claim or to send a notice to the provider stating why the payment has been delayed or denied. Failure to comply with this portion of the act results in the accrual of interest equal to 1% per month of the billed charges.

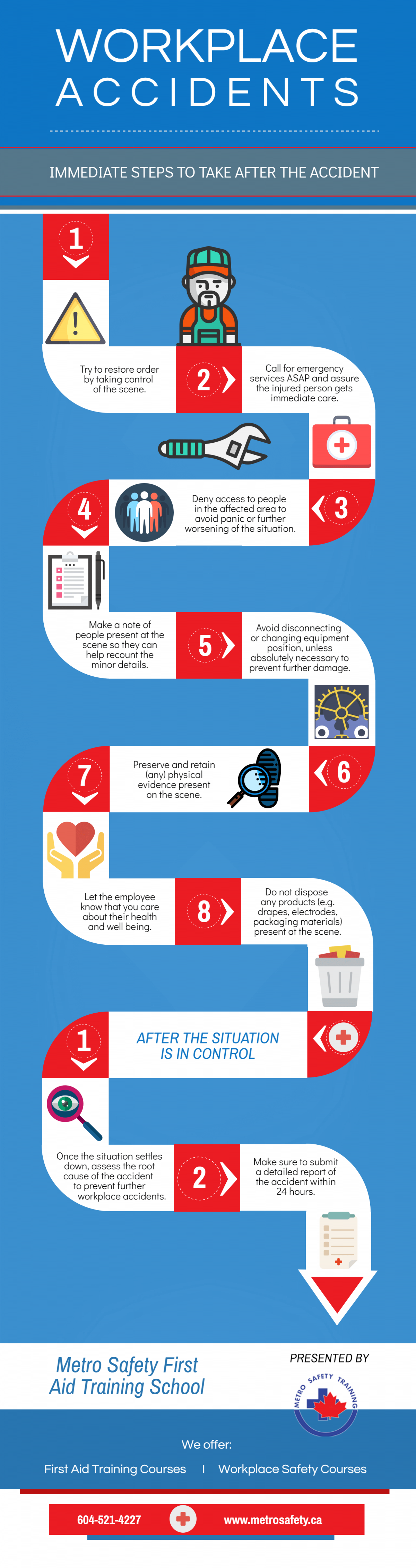

What should happen immediately after the accident has taken place?

Call the police to report the accident Dial 911 and wait for the police to arrive. Answers any questions so the police officer can file a police report. Provide driver’s license and insurance information. Tell the police exactly what happened and stick with the facts.

What should you do immediately whenever an accident occurs?

– Check yourself for injuries. If you’re injured, call 911 or ask someone else to do so. …

– Check on the well-being of your passengers. …

– Get to safety. …

– Call 911. …

– Wait for help. …

– Exchange information. …

– Document the accident. …

– Notify your insurer and start the claims process.

What should be done after the accident has occurred?

Call the police to report the accident Provide driver’s license and insurance information. Tell the police exactly what happened and stick with the facts. Ask for the name and badge number of all officers you engage with. Request a copy of the police report for your insurance company.

What are some follow up tasks after a car accident?

– Stay at the Scene (and Avoid Further Accidents) …

– Exchange Information. …

– Report the Accident to Police. …

– Take Pictures. …

– Talk to Any Witnesses. …

– Limit Your Conversation with the Other Driver. …

– See a Doctor. …

– Keep Detailed Records.

What are the actions after an accident?

Call the appropriate police agency to document the accident immediately. Call 911! Don’t move your vehicle unless instructed to by the police. Tend to your injuries and the occupants of your vehicle.