Personal accident cover, also known as personal accident insurance, is a type of insurance policy that provides financial protection in the event of accidents or injuries. It offers coverage for medical expenses, disability benefits, and in some cases, death benefits.

There are several reasons why getting personal accident cover is worth considering. Firstly, accidents can happen to anyone at any time, regardless of their age, occupation, or lifestyle. Having this insurance can provide you with peace of mind knowing that you are financially protected in case of any unforeseen accidents.

Secondly, medical expenses can be extremely high, especially in situations where long-term treatment or rehabilitation is required. Personal accident cover can help alleviate the financial burden by covering the costs of medical bills, hospital stays, surgeries, and medications.

Additionally, in cases where accidents result in temporary or permanent disability, this insurance can provide disability benefits to help with income replacement or necessary lifestyle adjustments.

Furthermore, personal accident cover can also include death benefits, which can provide financial support to the insured’s family or dependents in the unfortunate event of their death due to an accident.

Finally, personal accident insurance is usually affordable and can be tailored to suit individual needs and budgets. It offers flexible coverage options, allowing you to choose the level of protection that suits your specific requirements.

In conclusion, personal accident cover is worth getting as it offers financial protection, peace of mind, and assistance with medical expenses, disability benefits, and death benefits. It is a valuable insurance policy that helps ensure that you and your loved ones are financially secure in case of accidents or injuries.

What does an accidental policy cover?

Simply put, accident insurance is a form of insurance policy that offers a payout when people experience injury or death due to an accident.

What is covered under personal accident insurance?

This is an accidental death & dismemberment (AD&D) insurance plan. It pays a benefit based upon a schedule of benefits in the event of accidental death, dismemberment, or permanent total disability as the result of an accident.

What is covered by personal accident insurance policy?

Accident insurance covers qualifying injuries, which might include a broken limb, loss of a limb, sprains, broken bones, concussions, burns, lacerations, or paralysis. In the event of your accidental death, accident insurance pays out money to your designated beneficiary.Sep 1, 2023

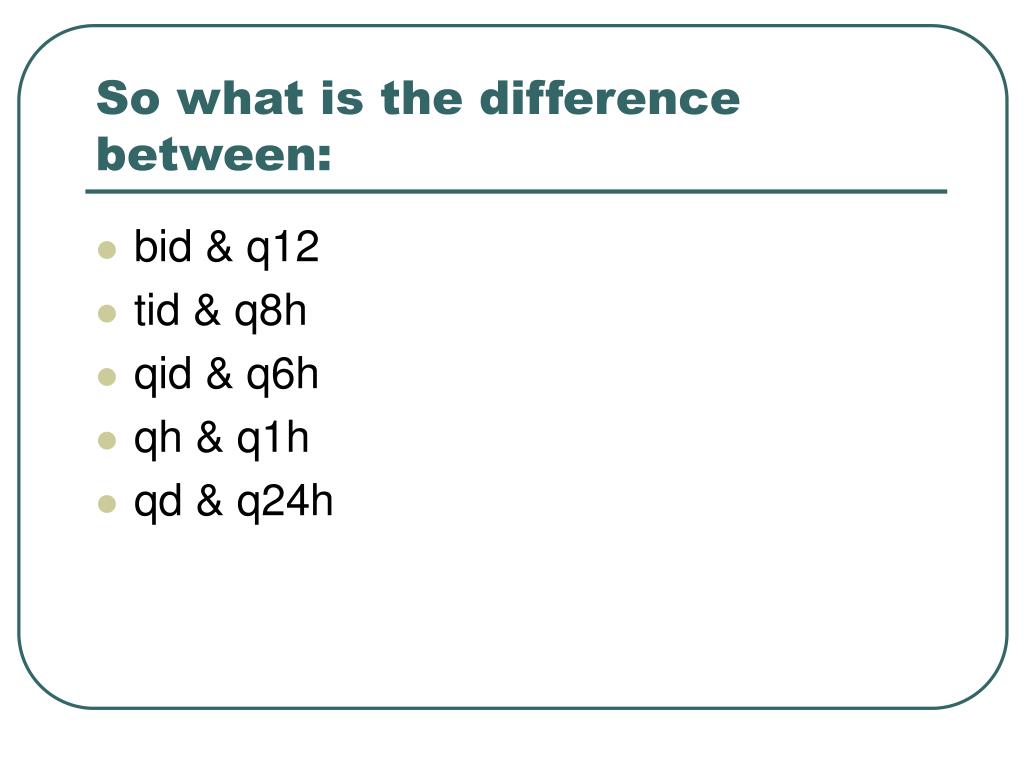

What is the meaning of BD and HS?

BDS (bis die sumendum) or BD or BID (bis in die) means “twice daily”. TDS (ter die sumendus) means “three times a day”. HS (hora somni) means “at bedtime”.Jan 5, 2019

What is TDS in prescription drugs?

TDS means three times a day. So, the question is how many hours apart from each dose? It depends but the golden rule of TDS is always every 8 hours.

What is the difference between Qid and tid?

t.i.d. (or tid or TID) is three times a day ; t.i.d. stands for “ter in die” (in Latin, 3 times a day). q.i.d. (or qid or QID) is four times a day; q.i.d. stands for “quater in die” (in Latin, 4 times a day).

What is BD and TID in medical terms?

BID: bis in die, twice a day; TID: ter in die: three times a day.

What is OD BD and TDS in medical terms?

OD means once a day, BD means twice a day and TDS or TID means three times a day. Normally refers to the number of times you have to take a specific medicine in one day.