Accident insurance, also known as personal accident insurance or accidental death and dismemberment insurance, is a type of insurance coverage that provides financial protection in the event of an accident resulting in injury, disability, or death. In today’s fast-paced and unpredictable world, accident insurance has become increasingly important.

Accidents can occur at any time and in various forms, such as car crashes, falls, sports injuries, or even natural disasters. These unexpected events can have serious consequences, not only physically but also financially. Medical expenses, rehabilitation costs, and loss of income due to disability can put a significant strain on a person’s finances.

Having accident insurance can alleviate some of these financial burdens. It typically provides coverage for medical expenses, hospital stays, surgical procedures, rehabilitation, and even funeral costs in case of death. By having this insurance, individuals can ensure that they have access to necessary medical treatments and receive prompt care without worrying about the hefty expenses involved.

Furthermore, accident insurance often includes disability benefits, which can provide individuals with income replacement if they are unable to work due to the accident. This can help maintain a certain level of financial stability and ensure that bills and other financial obligations are met.

Accidents can happen to anyone, regardless of age or occupation, making accident insurance essential for people of all walks of life. Whether it’s providing financial support to cover medical expenses or offering a safety net during a period of disability, accident insurance offers peace of mind and security to individuals and their families.

In conclusion, accident insurance plays a crucial role in today’s uncertain world. It provides financial assistance in the event of an accident, covering medical costs, rehabilitation, and even income replacement. It is an essential tool to mitigate the financial impact of accidents and ensure individuals can focus on their recovery without worrying about the burden of expenses.

Is it worth getting personal accident cover?

Accident insurance covers more than just injuries. Many plans come with ancillary benefits for limb loss, accidental death, paralysis, or blindness. Having that extra protection can keep you (or your loved ones) from taking the full financial impact of a serious accident.

Should I get a personal accident plan?

Accidents can be costly expenditures, and not everyone has a rainy-day fund ready for use. Accident insurance is worth it if you are looking for extra financial support when an unexpected event happens. Certain individuals may especially benefit from getting supplemental accident insurance.

Is it necessary to take personal accident insurance?

Some people might think accident insurance is needed only if you’re accident-prone or work a dangerous job. But Baechle says accident insurance can cover everyday accidents like broken bones or burns. Your accident insurance plan can also include coverage for your children.

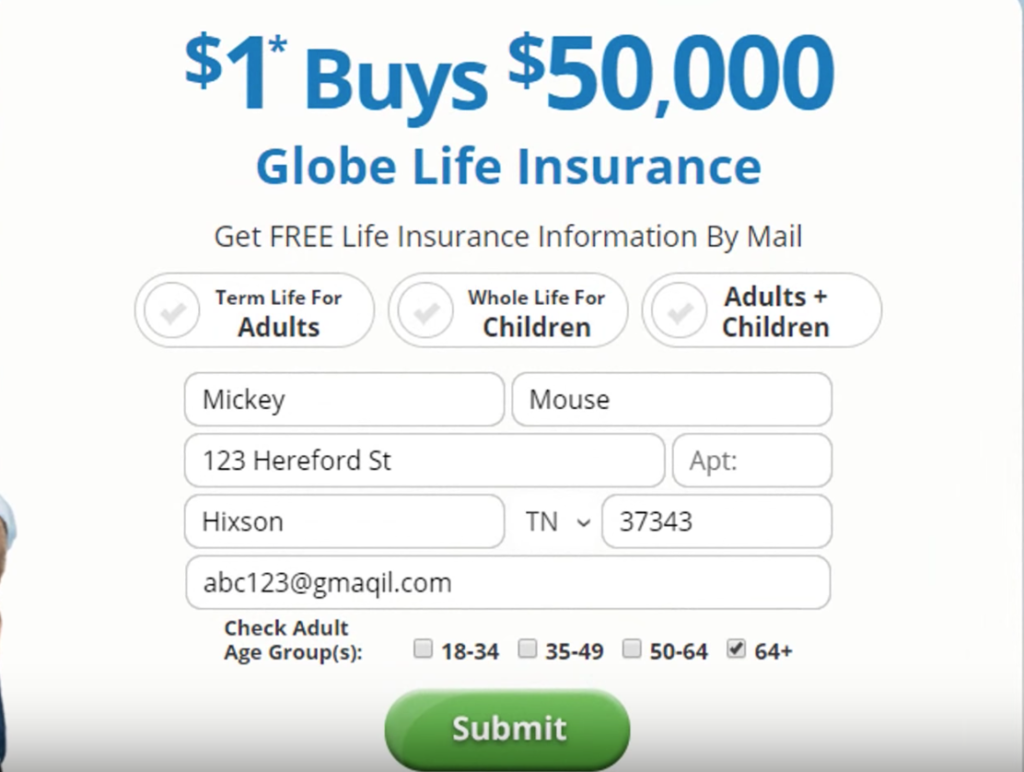

How long does it take to get life insurance money from Globe Life?

For more information about the claims filing process, see the Life Claim Filing Instructions above. Once my claim has been processed, how long will it take to receive my check? Typically, you will receive your check within 10 – 15 business days from the time your claim was processed.

What does accidental life insurance cover?

What is AD&D insurance? Accidental death and dismemberment (AD&D) insurance is a category of life insurance that only pays out a benefit when the insured is in a covered accident that causes death or specific serious injuries such as the loss of a limb, paralysis, or blindness.

Does Globe Life insurance pay claims?

Globe Life pays most claims within a few days, but how long it takes to receive a death benefit payment can vary based on your individual circumstance and the type of policy, according to the insurer. The best way to determine how long a claim will take is to contact your life insurance company directly.

What type of insurance does Globe Life offer?

Types of Globe Life Insurance Policies. Globe Life sells term life, whole life, children’s life insurance and accidental death insurance. In addition, it offers final expense insurance (also called burial insurance) and mortgage protection insurance.