Take 20% of your income and put it from your checking to savings accounts and investments. Next, set up another automatic transfer and put 10% which will go towards donations/ extra debt payments. The remaining 70% in your checking account will be used on the essentials.

What is the 40 40 20 budget rule?

The 40/40/20 rule comes in during the saving phase of his wealth creation formula. Cardone says that from your gross income, 40% should be set aside for taxes, 40% should be saved, and you should live off of the remaining 20%.

What is the #1 rule of personal finance?

#1 Don’t Spend More Than You Make When your bank balance is looking healthy after payday, it’s easy to overspend and not be as careful. However, there are several issues at play that result in people relying on borrowing money, racking up debt and living way beyond their means.

What is the 70 20 10 rule for personal finance?

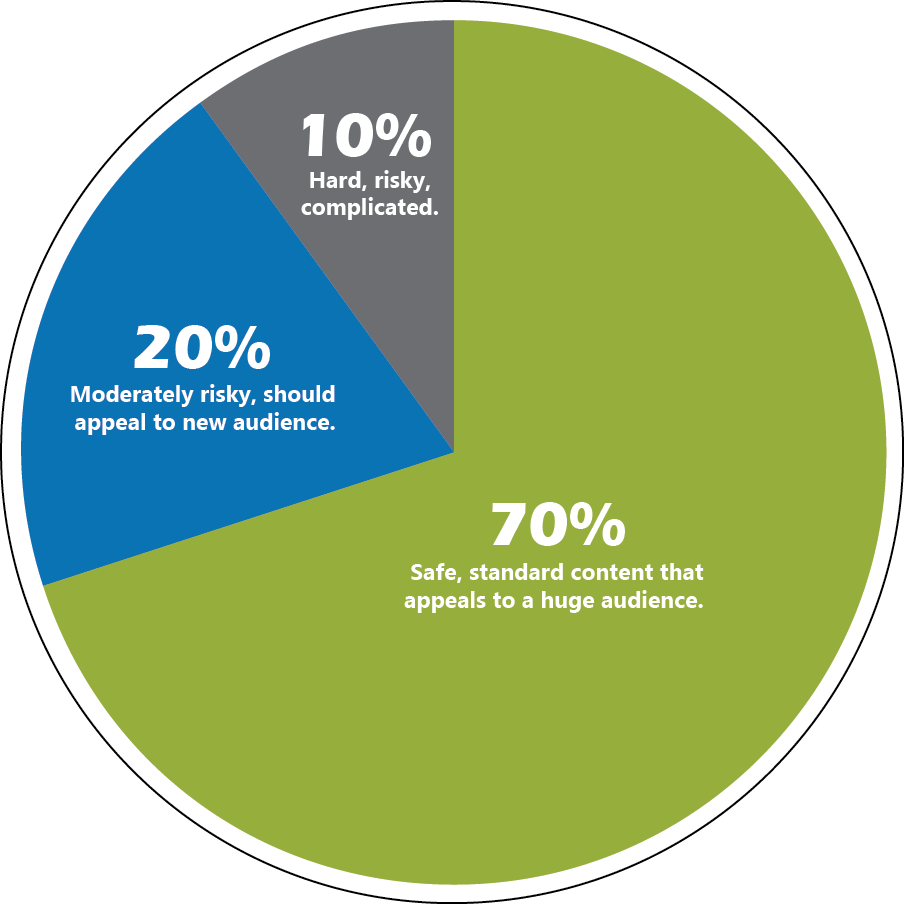

The 70-20-10 budget formula divides your after-tax income into three buckets: 70% for living expenses, 20% for savings and debt, and 10% for additional savings and donations. By allocating your available income into these three distinct categories, you can better manage your money on a daily basis.

What is the 50 30 20 rule in finance?

The 50-30-20 rule recommends putting 50% of your money toward needs, 30% toward wants, and 20% toward savings. The savings category also includes money you will need to realize your future goals.

How do you distribute your money when using the 70 20 10 rule?

Take 20% of your income and put it from your checking to savings accounts and investments. Next, set up another automatic transfer and put 10% which will go towards donations/ extra debt payments. The remaining 70% in your checking account will be used on the essentials.

How does the 30 percent rule work?

You may have heard it—the rule that says “Don’t spend more than 30% of your gross monthly income on housing.” The idea is to ensure you still have 70% of your income to spend on other expenses.

What is the #1 rule of personal finance?

#1 Don’t Spend More Than You Make When your bank balance is looking healthy after payday, it’s easy to overspend and not be as careful. However, there are several issues at play that result in people relying on borrowing money, racking up debt and living way beyond their means.

What is the 70 20 10 rule for personal finance?

The 70-20-10 budget formula divides your after-tax income into three buckets: 70% for living expenses, 20% for savings and debt, and 10% for additional savings and donations. By allocating your available income into these three distinct categories, you can better manage your money on a daily basis.

What is the 30 rule in finance?

It’s the idea that you should budget a minimum of 30% of your gross monthly income (i.e., your before-tax income) for housing costs, and it’s practically a personal finance gospel. Rent calculators often use the 30% rule as a default assumption to determine how much house you can afford.May 8, 2024