Yes, Viva Finance does check credit when considering loan applications. The company understands the importance of credit history in determining the creditworthiness of an individual. By checking credit, Viva Finance can assess the risk associated with lending money to a borrower.

Credit checks are a standard practice in the financial industry, as they provide valuable information about an individual’s financial behavior and ability to repay debts. Viva Finance uses credit checks to evaluate the likelihood of a borrower making timely loan payments and to determine the terms of the loan, such as the interest rate and loan amount.

While having good credit can increase the chances of loan approval and favorable loan terms, Viva Finance also considers other factors when evaluating loan applications, such as income, employment history, and debt-to-income ratio. Even if an individual has less-than-perfect credit, they may still be eligible for a loan from Viva Finance, albeit with higher interest rates or stricter repayment terms.

Overall, credit checks are an important part of the loan approval process at Viva Finance, as they help the company make informed decisions about lending money to borrowers. By checking credit, Viva Finance can ensure responsible lending practices and protect both the borrower and the company from financial risks.

What is the minimum credit score to finance?

Many give preference to borrowers with good or excellent credit scores (690 and above), but some lenders accept borrowers with bad credit (a score below 630). The typical minimum credit score to qualify for a personal loan is 560 to 660, according to lenders surveyed by NerdWallet.

Does Viva Finance check credit score?

Viva Finance caters to employees that need financial assistance for various expenses. Approval is based almost entirely on the borrower’s employment history, so a low credit score may not disqualify you.

What documents do I need for Viva Finance?

The most common documents needed are 2 most recent paystubs, a hire date documents, and a government issued identity.

How does Vivaloan work?

Vivaloan is a personal loan marketplace that partners with a variety of lenders to provide loan options in amounts ranging from $100 to $15,000. Vivaloan is not a lender and does not make loans itself.

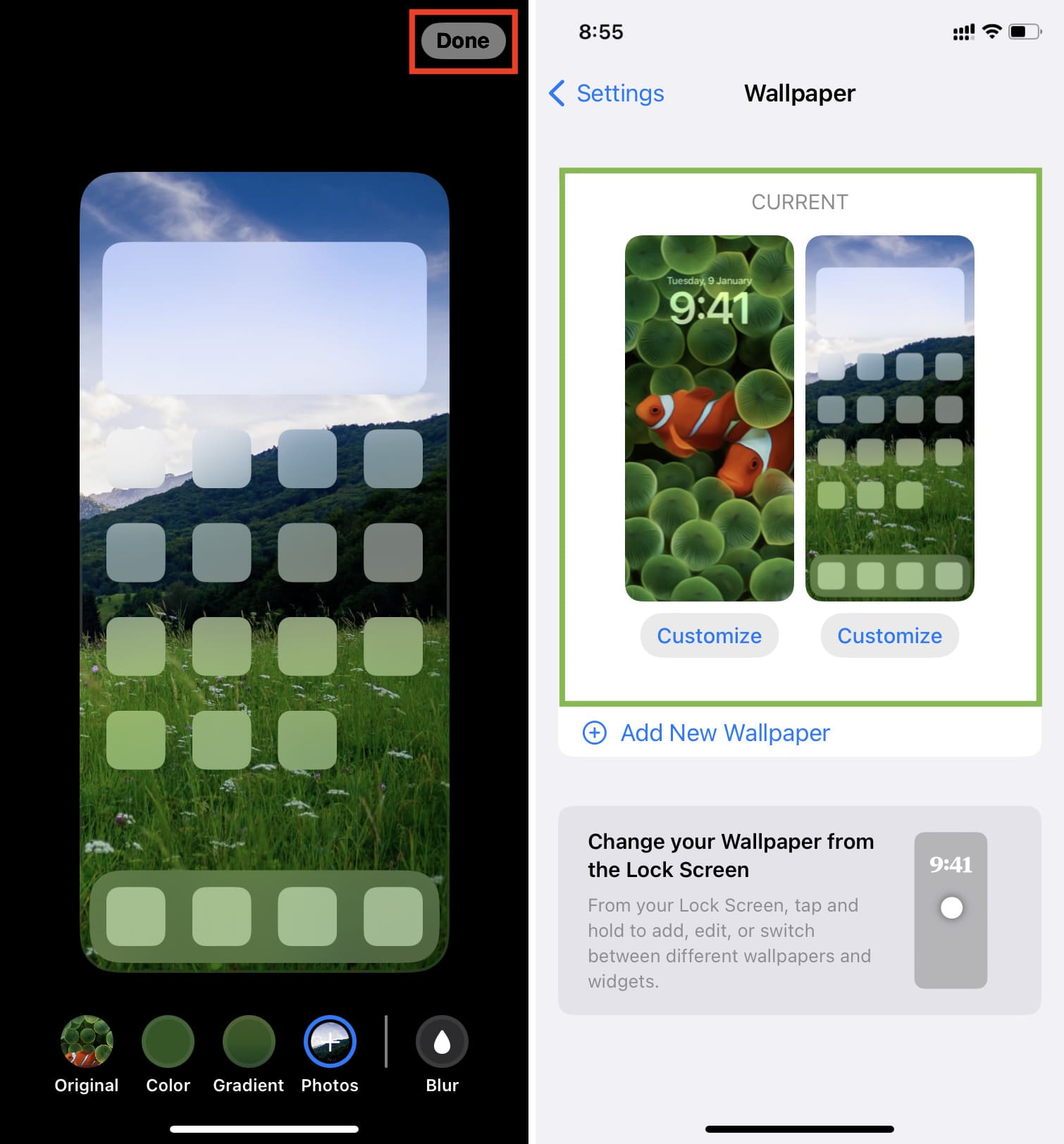

How do I customize my iPhone background?

– In the Settings app, tap Wallpaper.

– Tap Add New Wallpaper.

– Tap Photos, People, Photo Shuffle or Live Photo to choose your own photo. …

– If you want to, you can customise your wallpaper Then tap Add.

How do I change my home screen?

Press and hold an empty space on your home screen. This will bring up the home screen settings. Tap “Wallpapers” to change the background image or color of your home screen. Tap “Widgets” to add widgets, which are mini-apps that provide information or quick access to certain functions.

How do I put different wallpapers on my iPhone screen?

– In the Settings app, tap Wallpaper.

– Tap Add New Wallpaper.

– Tap Photos, People, Photo Shuffle, or Live Photo to choose your own photo. …

– If you want, you can customize your wallpaper further. …

– Tap Set as Wallpaper Pair and your selection will be seen on both the Home Screen and Lock Screen.

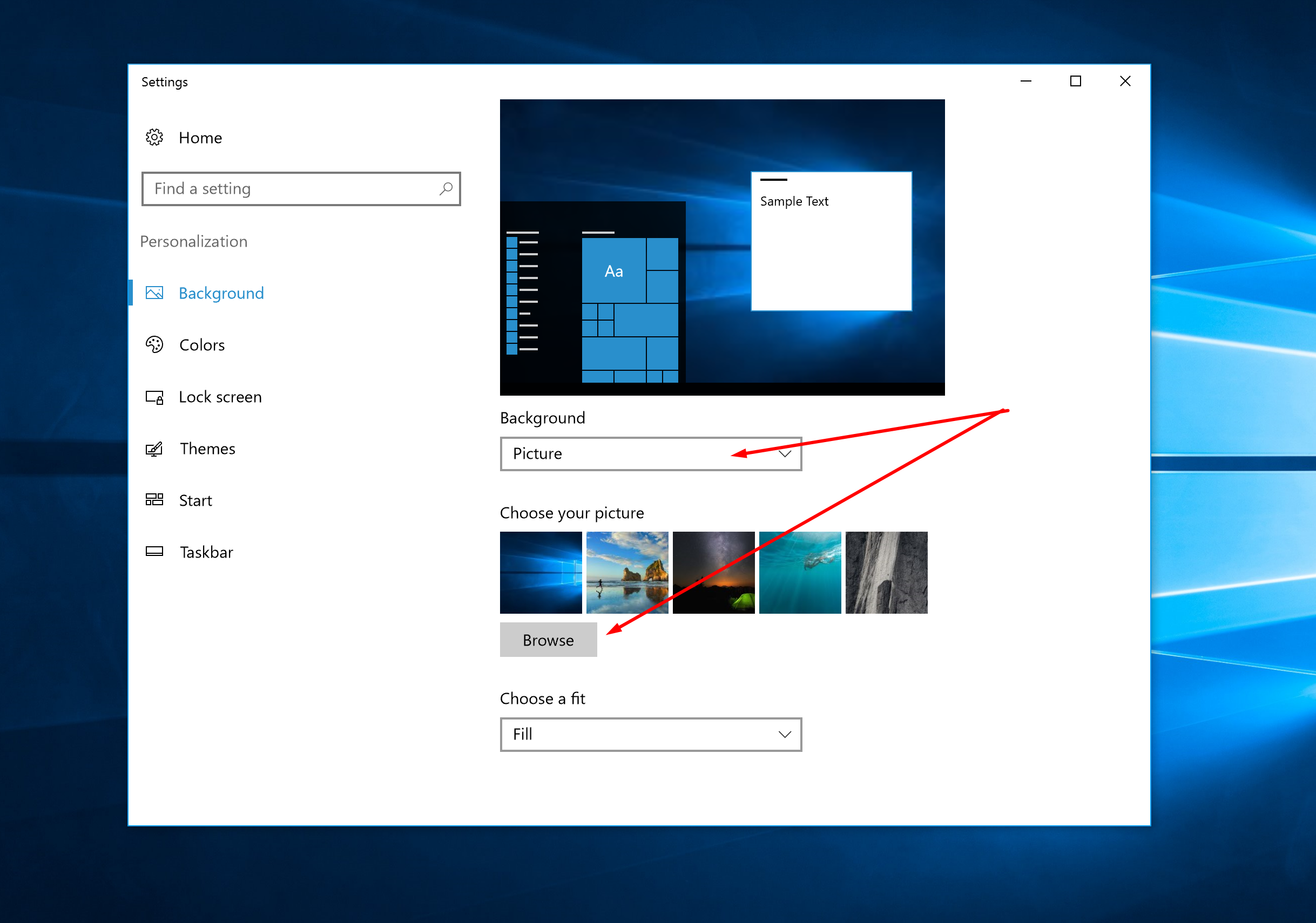

How do I change my wallpaper?

– Select Start > Settings > Personalization > Background.

– In the list next to Personalize your background, select Picture, Solid color, Slideshow, or Windows Spotlight (to see a new image from around the world every day).

How do I customize my iPhone wallpaper?

– In the Settings app, tap Wallpaper.

– Tap Add New Wallpaper.

– Tap Photos, People, Photo Shuffle or Live Photo to choose your own photo. …

– If you want to, you can customise your wallpaper Then tap Add.